return on investment , roi

Getting into real estate investment can be both exciting and overwhelming, especially for first-time investors. One of the most important things to understand early on is ROI—Return on Investment. This simple yet powerful metric can help you determine whether your rental property is actually making you money, and more importantly, how to improve those returns.

In this blog, we’ll break down what ROI means in real estate, how to calculate it, and what factors can significantly impact your profit. We’ll also look at simple strategies to boost your ROI and set you up for long-term success as a property owner.

What is ROI in Real Estate?

In this finance-savvy guide, we break down practical strategies to reduce vacancy periods and increase rental yield, while showcasing why tools like QuickRental.ca offer a smarter, faster path to tenant acquisition.

Getting ROI (Return on Investment) in real estate or rental property means ensuring that the money you earn from the property is higher than what you spend on it. Here’s how to calculate, track, and maximize ROI when renting out a house:

ROI = Annual Net ProfitTotal Investment×100\frac{\text{Annual Net Profit}}{\text{Total Investment}} \times 100Total InvestmentAnnual Net Profit×100

- Net Profit = Total Rental Income – (Operating Expenses + Mortgage + Repairs + Taxes)

- Total Investment = Purchase Price + Closing Costs + Renovation Costs + Furnishing (if any)

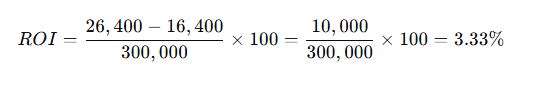

Example:

- Rental income: $2,200/month = $26,400/year

- Expenses (mortgage, tax, maintenance): $16,400/year

- Total investment in property: $300,000

Why ROI Matters?

Understanding ROI helps you make smarter decisions. Whether you’re thinking about buying your first property or already managing one, knowing your ROI helps you:

- Evaluate how well your investment is performing

- Compare multiple properties

- Plan for long-term financial goals

- Identify areas for improvement

A strong ROI means your property is generating good income relative to its cost, while a weak ROI could signal that you need to adjust your strategy.

Top Factors That Affect ROI

Not all rental properties generate the same returns. Several factors can influence how profitable your investment will be.

- Purchase Price vs. Market Value: Buying below market value immediately increases your potential profit. The less you spend upfront, the more room you have for income and growth. Many new investors make the mistake of overpaying, which puts pressure on their monthly returns.

- Rental Income The rent you charge is your main source of income from a rental property. Researching market rates in your area and setting a competitive price can make a big difference. Using platforms like QuickRental.ca, RentFaster.ca, or even Kijiji helps you gauge what similar properties are renting for.

- Operating Expenses and Vacancy Every property comes with ongoing costs: property taxes, insurance, repairs, maintenance, and possibly property management fees. If your place sits empty for even a month, that’s income lost. Keeping expenses low and minimizing vacancy are two of the most important ways to protect your ROI.

- Financing Terms The interest rate and length of your mortgage play a big role in your monthly cash flow. Lower interest rates or paying off your loan early can boost your ROI significantly over time.

- Location The old saying “location, location, location” still rings true. A home in a popular neighborhood near schools, transit, or shopping centers is more likely to rent quickly and at a higher price.

- Property Condition and Appeal A clean, updated, and well-maintained property attracts better tenants. Small upgrades like new paint, appliances, or lighting can increase your rental value without breaking the bank.

- Tenant Turnover Every time a tenant moves out, you may need to repaint, repair, and relist the property. Reducing turnover saves time, money, and effort. Keeping good tenants happy pays off.

How to Improve ROI?

Improving ROI doesn’t always mean spending more money. Many effective strategies are about working smarter.

Start with strong marketing. Use clear, high-quality photos and write detailed, accurate listings. Describe not just the property, but the lifestyle it offers. Mention nearby parks, schools, restaurants, or transit access.

Choose the right platforms. Posting on more than one website increases your visibility. QuickRental.ca, for example, focuses on SEO and mobile usability, helping your listing reach more tenants faster. This can shorten the time your property sits vacant.

Respond quickly to inquiries. The longer you wait, the more likely a potential tenant will move on. Being prompt and professional builds trust and can help close a deal faster.

Offer competitive, transparent pricing. Renters today are informed. They compare prices and want clarity on what they’re paying for. Being upfront about rent, utilities, and deposits can attract more serious tenants.

Invest in preventive maintenance. Fixing issues before they become big problems saves money in the long run. It also makes your property more attractive to potential renters.

Consider adding extra value. Things like in-unit laundry, Wi-Fi, or allowing pets can justify higher rent. These features are especially appealing in competitive rental markets.

Use automation tools. From collecting rent online to scheduling showings, automation can save you time and make the renting process smoother for both you and your tenants.

Tax Benefits and ROI

Many new investors overlook the power of tax deductions. You can often deduct mortgage interest, property taxes, insurance, repairs, depreciation, and even certain travel expenses related to managing the property.

These deductions lower your taxable income and effectively increase your overall return. Speak to an accountant or tax professional to make sure you’re taking advantage of all available benefits.

Common Mistakes That Hurt ROI

Here are some of the most common missteps that can drag down your returns:

- Overpaying for the property

- Underestimating repair and maintenance costs

- Setting rent too low or too high

- Ignoring property marketing

- Not screening tenants properly

- Waiting too long to respond to leads

- Managing everything manually without tools

Avoiding these mistakes can save you thousands of dollars and protect your investment over time.

Tracking Your ROI

You don’t need to be a financial expert to keep track of your ROI. A simple spreadsheet can help you track income, expenses, and net profit. Some landlords use tools like Stessa, Google Sheets, or property management apps to make this easier.

Update your numbers regularly and review your ROI at least once a year. This helps you stay informed and ready to make smart adjustments.

Final Thoughts

Understanding and improving ROI is one of the best things you can do as a new real estate investor. It turns your property from just another asset into a working income source. With smart decisions and the right tools, you can boost your rental income, reduce costs, and get the most out of your investment.

If you’re ready to rent your property faster and smarter, consider listing it on QuickRental.ca. It’s easy to use, mobile-friendly, and built to help you reach more renters without spending a fortune. Remember, the faster you rent, the quicker you earn—and that’s the foundation of great ROI.

1 thought on “Real Estate ROI Unlocked: How New Investors Can Earn More from Rentals”